Paul Warburg and the Development of the Central Banking System in America

Introduction

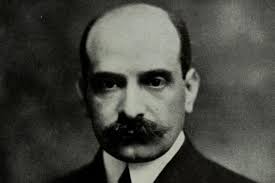

Paul Warburg, a pivotal figure in the establishment of the Federal Reserve System, played a crucial role in shaping modern American banking. As a banker and economist, his vision for a centralized banking system was instrumental in addressing the financial instability that characterized the United States in the early 20th century. This essay explores Warburg’s background, his contributions to American banking reform, and the establishment of the Federal Reserve, highlighting the significance of his work in the context of economic history.

Early Life and Background

- Family and Education

Paul Warburg was born on August 10, 1868, in Hamburg, Germany, into a prominent banking family. His father was a successful banker, which exposed Warburg to finance and economics from a young age. He studied at the University of Hamburg and later in the United States, where he deepened his understanding of the American banking system and its challenges.

- Career in Banking

After completing his education, Warburg began his career at the family bank, M.M. Warburg & Co. In 1902, he immigrated to the United States, where he worked for Kuhn, Loeb & Co., a prominent investment banking firm. His experiences in both German and American banking provided him with a unique perspective on the advantages of a centralized banking system, which contrasted sharply with the decentralized nature of American banking at the time.

The State of American Banking Pre-Federal Reserve

- Financial Instability

In the early 1900s, the American banking system faced significant challenges. The country experienced several banking panics, most notably the Panic of 1907, which revealed the vulnerabilities of a fragmented banking system. During this crisis, banks faced runs on deposits, leading to widespread insolvencies and economic turmoil.

- Need for Reform

The financial instability underscored the need for reform in the American banking system. There was a growing consensus among economists and policymakers that a central banking authority was necessary to provide stability, manage liquidity, and act as a lender of last resort. Warburg emerged as a key advocate for such reform, believing that a centralized system would help prevent future financial crises.

Warburg’s Advocacy for Central Banking

- The Aldrich Plan

In 1908, the U.S. Congress established the National Monetary Commission, tasked with investigating banking reform. Warburg became a prominent member of this commission and played a crucial role in formulating the Aldrich Plan, named after Senator Nelson Aldrich, which proposed the creation of a central banking institution. The plan called for a central bank with regional branches to provide stability and manage the money supply.

- Key Proposals

Warburg’s proposals included:

- Creation of a Central Bank:A centralized institution that would manage monetary policy and provide liquidity to banks.

- Elastic Currency:The ability to issue currency that could expand or contract based on economic conditions, providing flexibility during times of financial stress.

- Regulatory Oversight:The central bank would regulate and supervise member banks, ensuring sound banking practices and protecting depositors.

- Public Opposition and Challenges

Despite Warburg’s efforts, the Aldrich Plan faced significant opposition from various groups, including populists and smaller banks, who feared that a central bank would concentrate too much power in the hands of a few large institutions. Critics argued that it would threaten the independence of local banks and undermine democratic control of the economy.

The Birth of the Federal Reserve System

- Shift in Political Landscape

In 1912, the political landscape shifted with the election of Woodrow Wilson. Wilson, recognizing the need for banking reform, supported the idea of a central bank but sought a system that would address the concerns of critics of the Aldrich Plan. This led to the development of a new proposal.

- The Federal Reserve Act of 1913

On December 23, 1913, President Wilson signed the Federal Reserve Act into law, establishing the Federal Reserve System. Warburg’s vision and expertise were instrumental in shaping the final legislation. The new system created a decentralized central bank with regional Federal Reserve Banks, addressing concerns about concentration of power while still providing a framework for effective monetary policy.

- Structure of the Federal Reserve

The Federal Reserve System was designed with a dual mandate: to provide the country with a safer, more flexible, and more stable monetary and financial system. Key features included:

- Federal Reserve Banks:Twelve regional banks that acted as the operating arms of the Federal Reserve, serving as lenders to commercial banks and implementing monetary policy.

- Board of Governors:A central governing body overseeing the system, appointed by the President and confirmed by the Senate, ensuring accountability to the public.

- Federal Open Market Committee (FOMC):A committee responsible for setting monetary policy through open market operations, influencing interest rates and money supply.

Warburg’s Legacy and Impact

- Influence on Monetary Policy

Warburg’s contributions to the establishment of the Federal Reserve had a lasting impact on U.S. monetary policy. The Federal Reserve became a key institution in managing economic stability, controlling inflation, and responding to financial crises. Warburg’s advocacy for an elastic currency system laid the groundwork for modern monetary policy tools used by central banks today.

- Educational Efforts

Following the establishment of the Federal Reserve, Warburg continued to educate the public and policymakers about the importance of monetary policy and central banking. He wrote extensively on banking issues, helping to foster a better understanding of the economic principles that underpin the Federal Reserve’s operations.

- Continued Advocacy for Reform

Warburg remained an influential figure in banking reform throughout his life. He advocated for international monetary cooperation and the establishment of a global financial order, emphasizing the importance of collaboration among central banks to address global economic challenges.

Challenges and Controversies

- Criticism of the Federal Reserve

Despite its successes, the Federal Reserve has faced criticism and scrutiny throughout its history. Some critics argue that the Fed has too much power and lacks transparency. Others believe that its policies contribute to economic inequality and financial instability. Warburg’s vision of a centralized banking authority continues to be debated in light of these challenges.

- Economic Crises

The Federal Reserve’s actions during economic crises, including the Great Depression and the 2008 financial crisis, have sparked intense scrutiny. Critics have questioned the effectiveness of the Fed’s policies in managing economic downturns and maintaining financial stability. These debates underscore the complexity of monetary policy and the ongoing challenges faced by central banks.

Conclusion

Paul Warburg’s contributions to the development of the Federal Reserve System were instrumental in shaping the modern American banking landscape. His advocacy for a centralized banking authority, combined with his vision for an elastic currency and regulatory oversight, laid the foundation for a more stable and flexible financial system.

Warburg’s legacy endures in the ongoing discussions about the role of central banks in managing the economy, the balance of power in financial regulation, and the importance of public confidence in the banking system. As we navigate the complexities of the modern financial landscape, Warburg’s insights and innovations continue to resonate, reminding us of the critical role that effective banking systems play in promoting economic stability and growth